What are the resources for financial planning guides for international students in the US?

As an international student in the US, managing finances can be overwhelming. This question is crucial for students who want to navigate the complex financial landscape. Fortunately, there are several resources available to help international students plan their finances effectively, from government websites to private organizations, and we will explore them in this article to provide a comprehensive guide.

Financial Planning Guides for International Students in the US

Financial planning is a crucial aspect of studying abroad, and international students in the US have access to a variety of resources to help them manage their finances effectively. These resources provide guidance on topics such as budgeting, saving, and investing, which are essential for making the most of their time in the US. International students can find these resources through their university's financial aid office, online financial planning websites, and non-profit organizations that specialize in supporting international students.

Online Resources for Financial Planning

There are numerous online resources available to international students in the US, including websites, blogs, and forums. These resources offer a wealth of information on financial planning, including budgeting templates, saving strategies, and investment advice. Some popular online resources include the National Association of Financial Aid Administrators (NASFAA) and the Financial Planning Association (FPA). These organizations provide free resources and guides to help international students manage their finances effectively.

University-Based Resources for Financial Planning

Many universities in the US offer financial planning resources specifically designed for international students. These resources may include financial literacy programs, one-on-one counseling, and workshops on topics such as budgeting and saving. Universities may also offer scholarships and grants to help international students cover the cost of tuition and living expenses. The following table provides some examples of university-based resources for financial planning:

| Resource | Description |

|---|---|

| Financial Aid Office | Provides guidance on financial aid options, including scholarships and grants |

| Financial Literacy Program | Offers workshops and one-on-one counseling on topics such as budgeting and saving |

| International Student Organization | Provides support and resources specifically for international students, including financial planning guidance |

These resources can help international students in the US make the most of their time abroad and achieve their financial goals. By taking advantage of these resources, international students can develop good financial habits and set themselves up for long-term financial success.

How to get financial aid for international students in USA?

Getting financial aid for international students in the USA can be a challenging task, but there are several options available. International students can explore various scholarships, grants, and loans to help fund their education. Many universities in the USA offer financial assistance to international students, and some even have specific programs for international students. Additionally, there are several external organizations that provide financial aid to international students. To get started, international students should research the eligibility criteria and application requirements for each financial aid option.

Types of Financial Aid for International Students

There are several types of financial aid available to international students in the USA, including merit-based scholarships, need-based grants, and loans. Some universities also offer teaching assistantships or research assistantships to international students. Here are some options to consider:

- MERIT-BASED SCHOLARSHIPS: These scholarships are awarded to international students who demonstrate academic excellence or exceptional talent.

- NEED-BASED GRANTS: These grants are awarded to international students who demonstrate financial need and are typically based on the student's family income and assets.

- LOANS: International students can also apply for private loans or government loans to help fund their education, but these often require a co-signer and may have higher interest rates.

How to Apply for Financial Aid as an International Student

To apply for financial aid as an international student, you will typically need to submit a separate application in addition to your admissions application. Here are some steps to follow:

- RESEARCH FINANCIAL AID OPTIONS: Research the financial aid options available at your chosen university and external organizations that provide financial aid to international students.

- MEET THE ELIGIBILITY CRITERIA: Ensure you meet the eligibility criteria for each financial aid option, including academic requirements and language proficiency.

- SUBMIT THE APPLICATION: Submit the financial aid application and all required documents, including transcripts, test scores, and financial statements, by the deadline.

What organization helps international students?

The organization that helps international students is the International Student Organization. This organization provides a range of services and support to international students, including cultural orientation, language support, and academic advising. They also offer social events and activities to help international students connect with each other and with the local community.

Types of Organizations that Help International Students

There are several types of organizations that help international students, including university organizations, government agencies, and non-profit organizations. These organizations provide a range of services, including:

- Language support: providing language classes and tutoring to help international students improve their language skills

- Cultural orientation: providing information and support to help international students understand and navigate the local culture

- Academic advising: providing guidance and support to help international students choose their courses and plan their academic program

Benefits of Organizations that Help International Students

The organizations that help international students provide a range of benefits, including improved academic performance, increased cultural awareness, and enhanced social connections. These benefits can be achieved through:

- Mentorship programs: pairing international students with local students or mentors who can provide guidance and support

- Social events: organizing social events and activities that help international students connect with each other and with the local community

- Career support: providing guidance and support to help international students plan their careers and find job opportunities

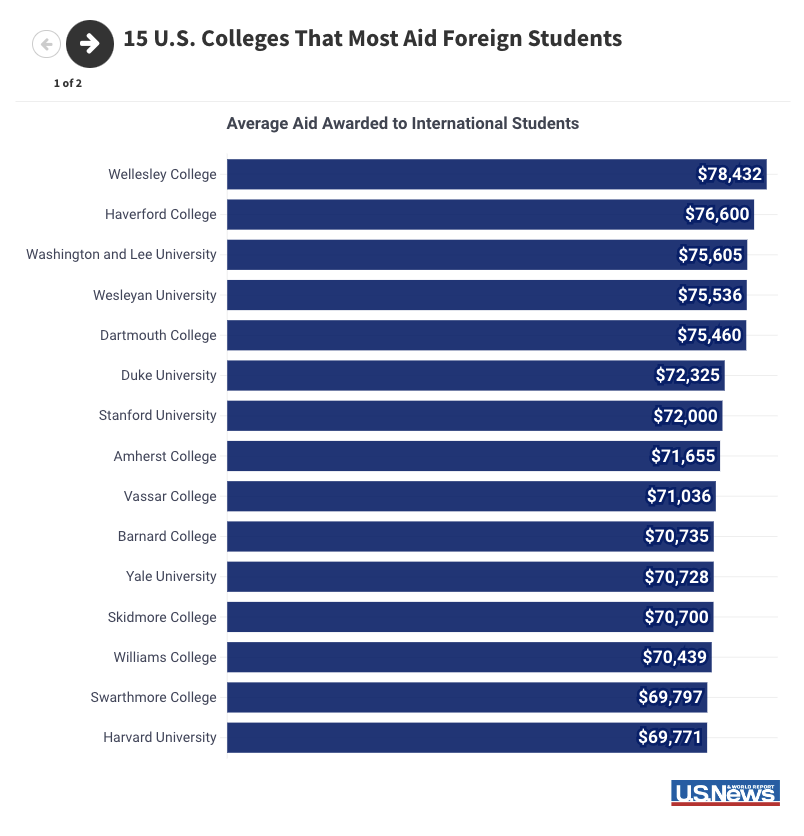

Which US universities give most financial aid to international students?

The US universities that give the most financial aid to international students are generally private institutions with large endowments. These universities offer need-based and merit-based aid to attract top talent from around the world. Some of the top universities that offer generous financial aid to international students include Harvard, Yale, and Princeton.

Top Universities for International Students

The top universities for international students in the US are those that offer a combination of academic excellence, diversity, and financial aid. These universities understand the challenges that international students face when studying abroad and provide support to help them succeed. Some of the key factors that international students consider when choosing a university include:

- Academic programs and majors

- Campus culture and community

- Career opportunities and internships

These universities offer a range of academic programs and research opportunities that cater to the diverse interests and goals of international students.

How to Apply for Financial Aid as an International Student

To apply for financial aid as an international student, you need to submit a range of documents, including your application, transcripts, and test scores. You may also need to complete a financial aid form, such as the CSS Profile or ISFAA, to demonstrate your financial need. Some key tips to keep in mind when applying for financial aid include:

- Submit your application early to increase your chances of receiving aid

- Make sure you meet the eligibility criteria for financial aid

- Follow up with the financial aid office to ensure that your application is being processed

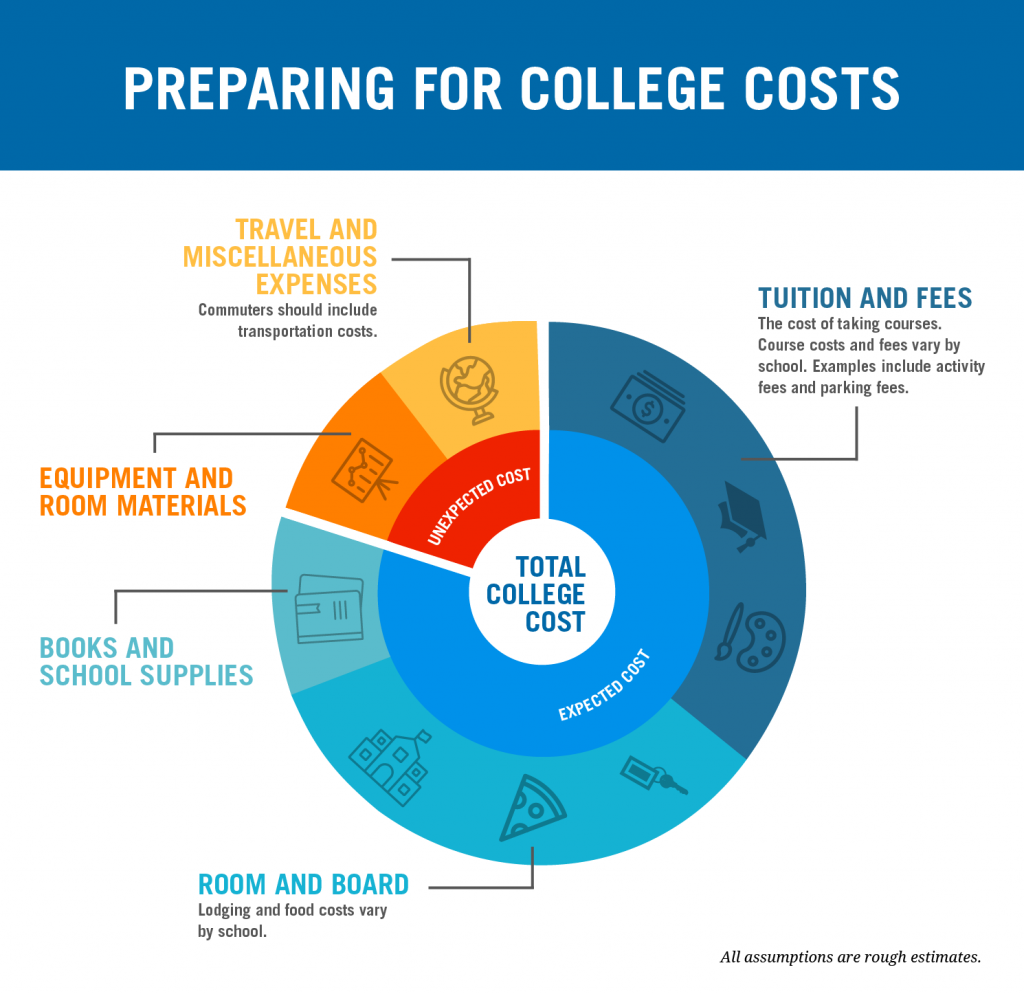

By following these steps and understanding the financial aid process, international students can increase their chances of receiving aid and achieving their academic goals in the US. International students should also research the cost of attendance and fees associated with their chosen university to ensure that they can afford to study in the US.

How can an international student earn money in the USA?

Earning money as an international student in the USA can be challenging, but there are several opportunities available. Many students rely on part-time jobs to support themselves financially while pursuing their education. The US government allows international students to work part-time on campus for up to 20 hours per week. Students can work in various roles such as library assistants, research assistants, or food service workers. Additionally, some students may be eligible to work off-campus through internships or co-op programs.

On-Campus Job Opportunities

On-campus jobs are a great way for international students to earn money while studying in the USA. These jobs are usually flexible and can be tailored to fit a student's class schedule. Some popular on-campus job opportunities include:

- Tutoring: Many students offer tutoring services to their peers in subjects they excel in.

- Research assistance: Students can work with professors or researchers on various projects and earn a stipend.

- Campus events: Students can work at campus events such as conferences, festivals, or sporting events.

Off-Campus Job Opportunities

Off-campus jobs can provide international students with more hours and pay than on-campus jobs. However, these jobs often require authorization from the US government and may have restrictions. Some popular off-campus job opportunities include:

- Internships: Students can apply for internships with companies in their field of study and gain practical experience.

- Co-op programs: Some universities offer co-op programs that allow students to work full-time for a semester or year and earn a salary.

- Freelance work: Students can offer their skills such as writing, design, or programming on a freelance basis and earn money.

Frequently Asked Questions

What are the best online resources for international students to learn about financial planning in the US?

The internet is a great place to start when it comes to financial planning for international students in the US. There are many websites and online forums that offer a wealth of information on topics such as budgeting, saving, and investing. Some popular online resources include the National Association of Student Financial Aid Administrators (NASFAA) and the College Board, which provide guides and tools to help students navigate the complex world of financial aid. Additionally, many universities and colleges have their own financial aid offices that offer counseling and advising services to help international students manage their finances. These online resources can be a great way for international students to get started with their financial planning, but it's also important to consult with a financial advisor or counselor who can provide more personalized advice. Many banks and credit unions also offer financial planning services specifically designed for international students, which can be a great way to get expert advice on topics such as taxes, health insurance, and credit scores. By taking advantage of these resources, international students can get a better understanding of how to manage their finances and make the most of their time in the US.

Are there any specific financial planning guides for international students in the US that are available in print or digital format?

Yes, there are many financial planning guides available in both print and digital format that are specifically designed for international students in the US. Some popular examples include the International Student's Guide to Financial Aid and the Financial Planning for International Students e-book. These guides provide practical advice and tips on how to manage finances, avoid debt, and build credit as an international student in the US. They also cover topics such as tax planning, health insurance, and retirement savings, which are all important considerations for international students who plan to stay in the US for an extended period of time. These guides can be a great resource for international students who want to get a better understanding of how to manage their finances in the US. They are often written by experts in the field of financial planning who have experience working with international students, and they provide real-life examples and case studies to help illustrate key concepts. By reading these guides, international students can get a better understanding of how to make smart financial decisions and avoid common pitfalls such as overspending and accumulating debt. Additionally, many of these guides are available for free or at a low cost, making them a valuable resource for international students on a budget.

Can international students in the US get access to financial planning services or counseling from their university or college?

Yes, many universities and colleges in the US offer financial planning services or counseling to their international students. These services may include one-on-one counseling sessions, workshops, and seminars on topics such as budgeting, saving, and investing. Some universities also offer financial planning tools and resources on their website, such as budgeting worksheets and financial calculators. Additionally, many universities have partnerships with financial institutions that offer specialized financial products ... and services to international students, such as student loans and credit cards. These financial planning services can be a great way for international students to get personalized advice and guidance on how to manage their finances in the US. Many financial aid offices also offer counseling and advising services to help international students navigate the complex world of financial aid and scholarships. By taking advantage of these services, international students can get a better understanding of how to make smart financial decisions and avoid common pitfalls such as overspending and accumulating debt. Furthermore, many universities also offer workshops and seminars on topics such as tax planning and credit scores, which can be a great way for international students to learn more about personal finance and money management.